Discover Proven Methods for Effective Credit Repair Today

Wiki Article

Recognizing Just How Credit Score Repair Works to Improve Your Financial Health And Wellness

The process encompasses recognizing mistakes in credit history reports, challenging mistakes with credit scores bureaus, and discussing with lenders to attend to superior financial debts. The concern stays: what specific methods can people use to not only rectify their credit report standing but additionally make certain long lasting monetary security?What Is Credit Score Repair Service?

Credit rating fixing refers to the process of improving a person's creditworthiness by dealing with inaccuracies on their credit record, negotiating debts, and embracing much better economic behaviors. This multifaceted method intends to enhance a person's credit history, which is a critical element in protecting car loans, bank card, and positive rate of interest prices.The credit score repair process typically begins with a complete evaluation of the individual's credit scores record, allowing for the recognition of any errors or discrepancies. As soon as mistakes are determined, the individual or a credit scores repair expert can start conflicts with credit report bureaus to correct these concerns. Furthermore, negotiating with financial institutions to work out arrearages can further improve one's economic standing.

In addition, adopting prudent financial practices, such as timely costs repayments, minimizing debt application, and preserving a diverse debt mix, contributes to a healthier credit profile. In general, credit scores repair offers as an important technique for people seeking to regain control over their monetary health and wellness and safeguard much better borrowing opportunities in the future - Credit Repair. By taking part in credit report repair work, individuals can lead the way toward accomplishing their economic goals and boosting their total high quality of life

Common Credit History Record Mistakes

Errors on credit report records can significantly affect a person's credit rating, making it essential to comprehend the typical kinds of inaccuracies that might arise. One widespread issue is inaccurate individual details, such as misspelled names, wrong addresses, or wrong Social Protection numbers. These errors can result in complication and misreporting of credit reliability.One more typical mistake is the coverage of accounts that do not come from the person, typically because of identity theft or clerical blunders. This misallocation can unfairly reduce a person's credit history score. Additionally, late repayments might be erroneously taped, which can occur as a result of payment processing mistakes or inaccurate reporting by lenders.

Credit scores restrictions and account balances can likewise be misstated, leading to an altered view of an individual's credit use proportion. Awareness of these typical mistakes is crucial for efficient credit administration and fixing, as addressing them quickly can assist people keep a healthier economic account - Credit Repair.

Steps to Dispute Inaccuracies

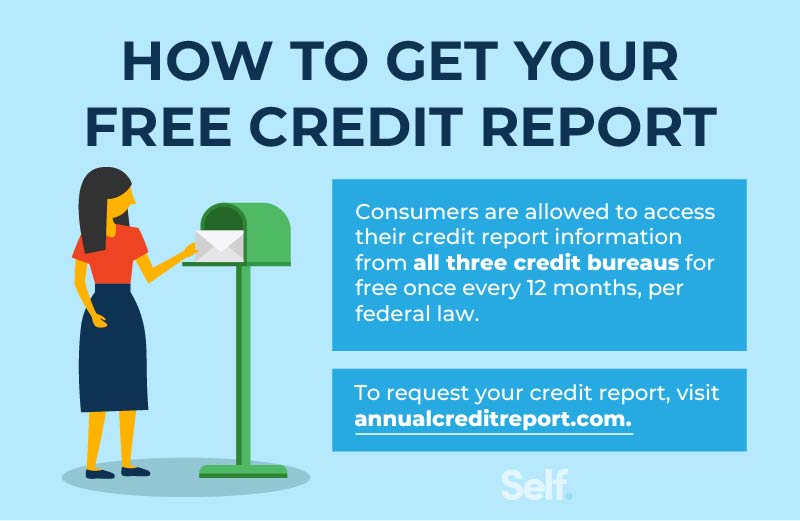

Contesting errors on a credit history record is a critical process that can assist bring back a person's credit reliability. The primary step involves acquiring a present duplicate of your credit rating report from all three major debt bureaus: Experian, TransUnion, and read the full info here Equifax. Review the report diligently to identify any type of mistakes, such as wrong account information, equilibriums, or payment backgrounds.As soon as you have actually determined discrepancies, gather supporting paperwork that corroborates your cases. This may consist of financial institution statements, payment confirmations, or communication with financial institutions. Next off, initiate the disagreement procedure by calling the appropriate debt bureau. You can usually file disagreements online, by means of mail, or by phone. When submitting your disagreement, clearly outline the errors, offer your proof, and include personal recognition information.

After the dispute is filed, the debt bureau will examine the insurance claim, generally within 30 days. Keeping accurate records throughout this process is crucial for effective resolution and tracking your credit history wellness.

Structure a Strong Credit History Account

Developing a strong credit history profile is crucial for safeguarding positive financial possibilities. Constantly paying credit report card expenses, lendings, and various other responsibilities on time is important, as payment background considerably impacts debt scores.Moreover, keeping low credit score use proportions-- ideally under 30%-- is vital. This indicates keeping bank card equilibriums well below their restrictions. Diversifying credit kinds, such as a mix of revolving credit history (charge card) and installment car loans (auto or home fundings), can additionally enhance credit score accounts.

On a regular basis checking credit rating reports for mistakes is just as crucial. People must assess their credit history records at the very least annually to identify disparities and dispute any type of errors immediately. Furthermore, staying clear of too much debt inquiries can stop possible negative influence on credit report.

Long-term Benefits of Credit Rating Fixing

Moreover, a more powerful credit score account can assist in much better terms for insurance coverage premiums and also affect rental applications, making it much easier to protect housing. The psychological advantages must not be ignored; individuals that efficiently repair their credit history frequently experience reduced stress and anxiety and enhanced confidence in managing their funds.

Verdict

In final thought, credit scores repair offers as an essential device for improving monetary wellness. By recognizing and contesting errors in credit report reports, individuals can remedy errors that adversely affect their credit rating ratings.

The long-term benefits of credit score fixing expand much beyond just enhanced credit score ratings; they can dramatically enhance an individual's overall financial health.

Report this wiki page